2021 individual federal income tax rate brackets

In Nominal Dollars Income Years 1862-2021 Married Filing Jointly Married Filing Separately Single Filer Head of Household Notes. Each block of income is taxed at the rate for that particular bracket.

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax on this income.

. Then 12 percent on the chunk of. Federal tax rates for 2022 15 on the first 50197 of taxable income plus 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus 26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625 plus. Your bracket depends on your taxable income and filing status.

TurboTax will apply these rates as you complete your tax return. 10 of taxable income. Over 19900 but not over.

Discover Helpful Information and Resources on Taxes From AARP. Say youre a single individual in 2021 who earned 70000 of taxable income. 5092 plus 325 cents for each 1 over 45000.

2020 Tax Brackets and Tax Rates for filing in 2021 2021 Tax Brackets and Tax Rates for filing in 2022 TurboTax Will Do It For You. Page 3 of 26. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly.

For 2021 the 22 tax bracket for singles went from 40526 to 86375 while the same rate applied to head-of-household filers with taxable income from 54201 to 86350. Federal 2022 income tax ranges from 10 to 37. Last law to change rates was the Tax.

380 reducing the states top marginal individual income tax rate from 6925 to 65 percent while consolidating seven. Ad Compare Your 2022 Tax Bracket vs. Your 2021 Tax Bracket to See Whats Been Adjusted.

Read customer reviews find best sellers. 19 cents for each 1 over 18200. These tax rate schedules are provided to help you estimate your 2021 federal income tax.

Each block is a tax bracket. Free easy returns on millions of items. Federal Individual Income Tax Rates and Brackets.

The 325 tax bracket ceiling lifted from 90000 to 120000. Ad Get Ready for Tax Season Deadlines. For a taxpayer with taxable income of 45000 the tax saving is 1080.

You would pay 10 percent on the first 9950 of your earnings 995. The personal exemption for tax year 2021 remains at 0 as it was for 2020. Taxpayers Filing Joint Returns Head of Household or Qualifying WidowsWidowers.

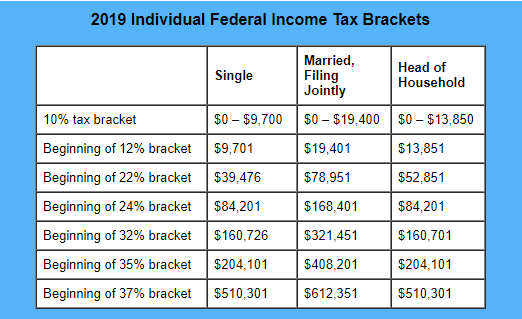

Take a look at the 2021 tax brackets if you filed single with 60000 in taxable income. 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040. Use the tables below to find your 2019.

Income tax tables and other tax information is sourced from the Federal Internal Revenue Service. Taxpayers Filing as Single Married Filing Separately Dependent Taxpayers or Fiduciaries. We can also see the progressive nature of South Carolina state income tax rates from the lowest SC.

For a taxpayer with taxable income of exactly 120000 the saving is 2430. Not all of your income is taxed at the highest rate for your income. Dec 16 2021 Cat.

The other rates are. Calculate your federal income tax bill in a few steps. Ad Free shipping on qualified orders.

The 19 rate ceiling lifted from 37000 to 45000. Year Rates Brackets Rates Brackets Rates Brackets Rates Brackets. 2021 Maryland Income Tax Rates.

Resident tax rates 202122. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Each bracket of income is taxed at a progressively higher rate.

This page has the latest Federal brackets and tax rates plus a Federal income tax calculator. These are the federal income tax brackets for 2021 and 2022. Find and Complete Any Required Tax Forms here.

Browse discover thousands of brands. 2021 Tax Table3 2021 EIC Table16-2-Department of the Treasury Internal Revenue Service.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Income Tax Brackets Brilliant Tax

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

2021 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

Low Tax Rates Provide Opportunity To Cash Out With Dividends

How Is Tax Liability Calculated Common Tax Questions Answered

2020 Federal Income Tax Brackets

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Tax Rates For Individual Income Tax Returns Filed In 2022 A Tax Haven

2021 Tax Brackets Standard Deductions Dsj Cpa

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Federal Income Tax Brackets Brilliant Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union